- Comprehensive Exness Funding Options

- Exness Deposit Methods

- Minimum Deposit Requirements

- How to Deposit Funds into Your Exness Account

- Processing Times and Fees for Deposits

- Exness Withdrawal Methods

- Minimum Withdrawal Requirements

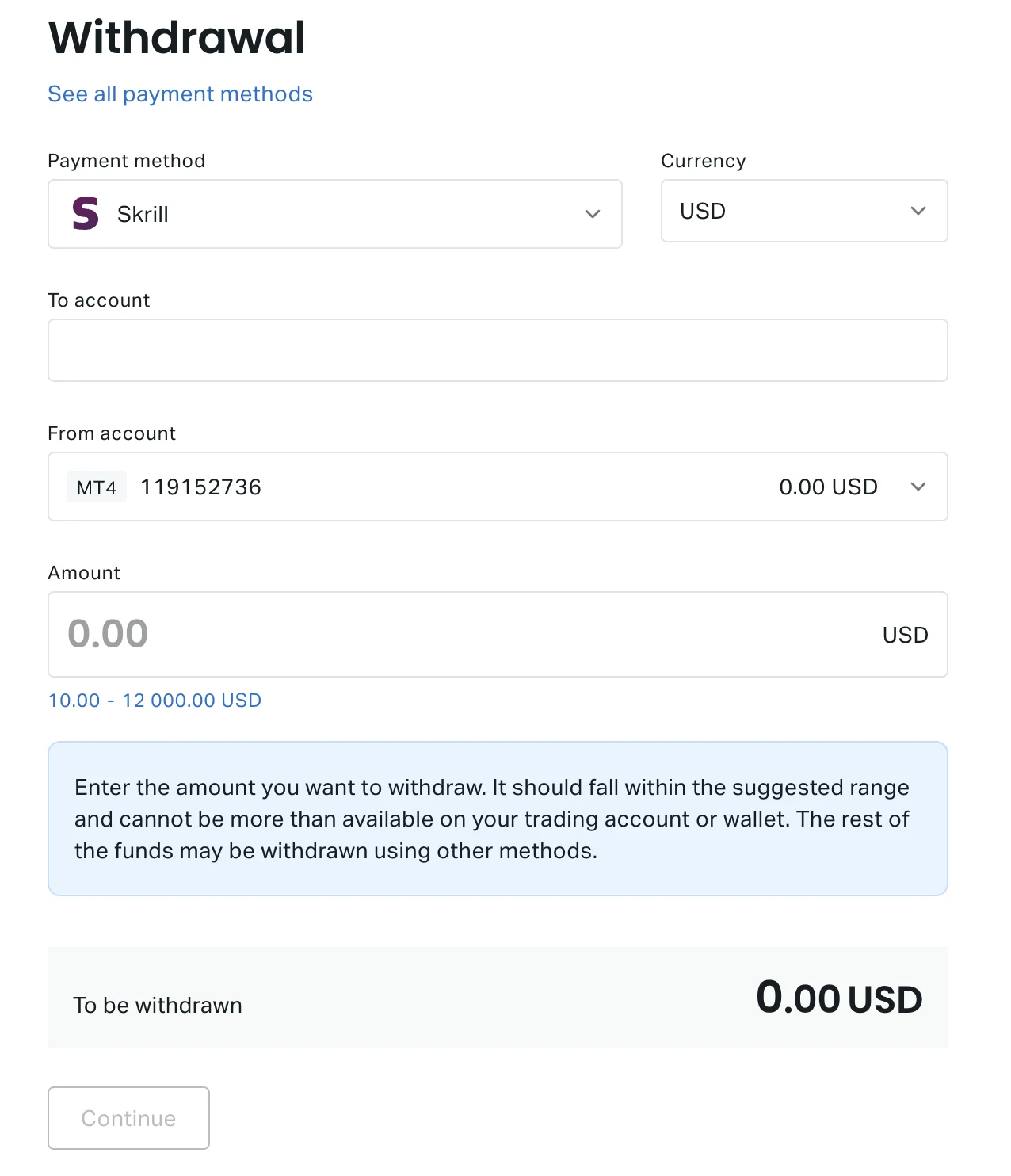

- How to Withdraw Funds from Your Exness Account

- Local Payment Options for Sri Lankan Traders

- Security Measures and Verification

- Troubleshooting Common Issues

- Choosing the Best Exness Payment Method for Your Needs

- Conclusion

- FAQ

Comprehensive Exness Funding Options

Exness cooperates with well-known payment companies in order to ensure the safety of your depositing and withdrawal procedures. After all, the company realizes how important it is for easy management of your funds for trading purposes.

| Payment Method | Minimum Deposit | Maximum Deposit | Deposit Fee |

| Credit/Debit Card | $10 | $40,000 | Free |

| Bank Wire Transfer | $100 | No limit | $10-$35 |

| Skrill | $5 | $40,000 | Free |

| Neteller | $20 | $30,000 | 2.5% |

| UnionPay | $100 | $100,000 | Free |

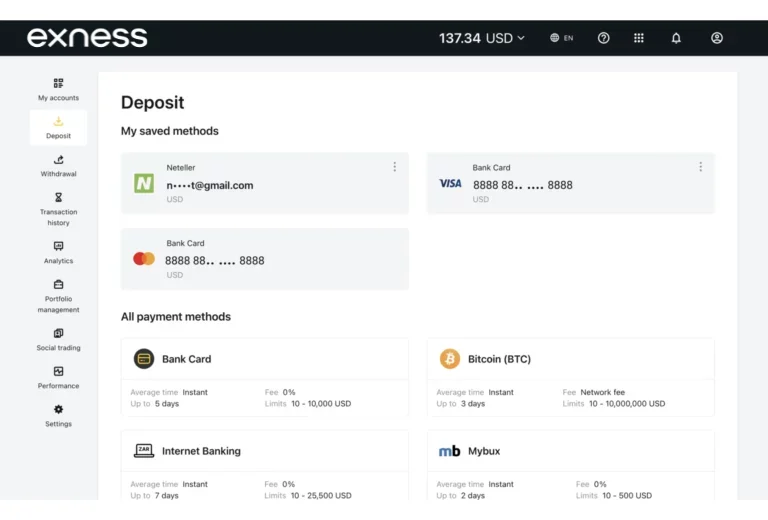

Exness Deposit Methods

Exness provides several ways of depositing money into an account, so that clients could opt for a variant which would be the most convenient personally for them.

Supported Deposit Methods

Supported Deposit Methods:

- Credit/debit cards: Visa, Mastercard, Maestro

- Bank wire transfers.

- E-wallets: Skrill, Neteller, UnionPay.

E-wallets are preferred to take advantage of the speed of money depositing into your account. Bank wires work best for big deposits, while credit/debit cards provide a very simple way.

Minimum Deposit Requirements

- E-wallets: Skrill, WebMoney – minimal deposit as low as $5.

- Bank wire transfers: $100 minimum deposit to cover the bank fee.

- Credit/debit cards: $10 minimum deposit.

Exness is trying to move the focus not on payments but on trading and provides very flexible and affordable deposit options.

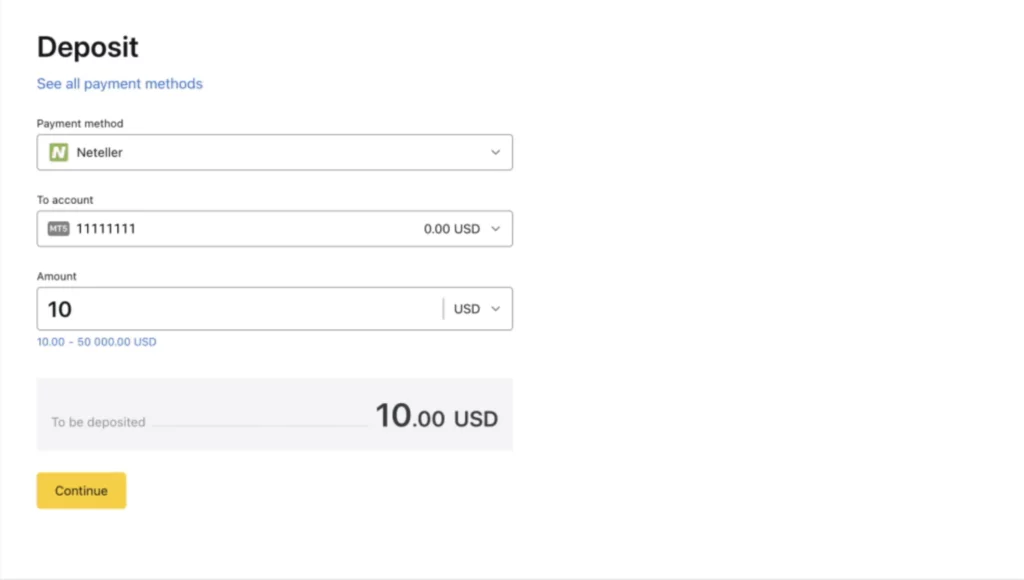

How to Deposit Funds into Your Exness Account

Funding your Exness trading account is easy and hassle-free using the steps shown below:

- Log in: Log in to your Exness account.

- Go to “Deposit”: Go to the “Deposit” section.

- Choose a Method: After that, you will have to select your preferred deposit method. These methods include:

- Credit/debit card;

- E-wallet (e.g., Skrill, Neteller);

- Bank wire transfer.

- Enter Details:

- Credit/debit card: You will need to fill in the details of your credit/debit card and the amount you wish to deposit.

- E-wallets: You will be redirected to the website of the chosen e-wallet to complete your deposit.

- Bank wires: Simply provide an account number and bank details.

The funds will be in your trading account within two clicks.

Processing Times and Fees for Deposits

Processing Times:

- E-wallets, Cards: The deposit time is instant or very fast.

- Bank Wires: Several days

- Most Deposit Methods: No charge on Exness’ part.

- Bank Wires: $10-$35 might be charged.

- E-wallets: Some, like Neteller, require a small percentage fee.

As for fees:

- E-wallets: Some, like Neteller, require a small percentage fee.

- Most Deposit Methods: No charge on Exness’ part.

- Bank Wires: $10-$35 might be charged.

Always check the specific fees and processing times for the method you chose to deposit with to know when your funds will be ready to trade.

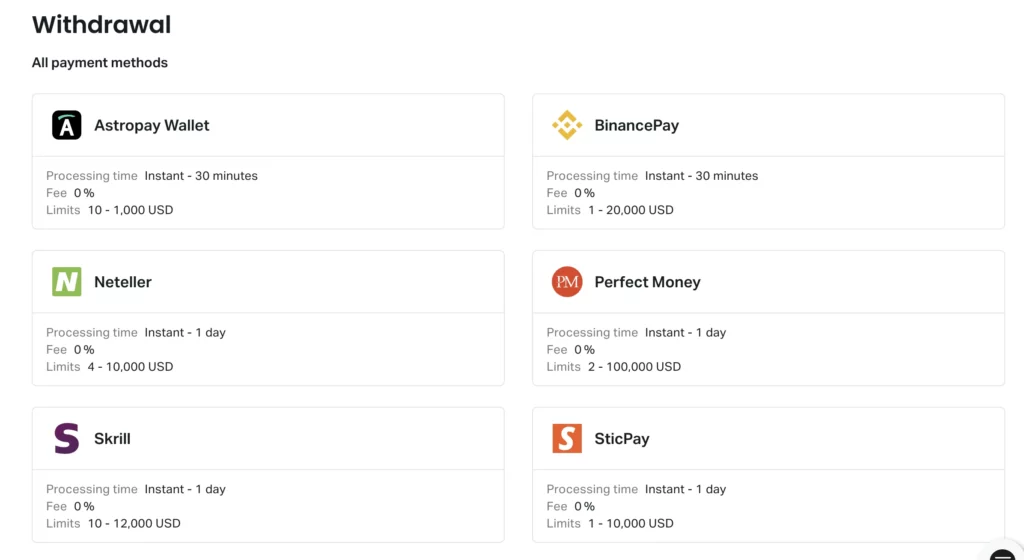

Exness Withdrawal Methods

Exness has different ways to withdraw your trading profits.

Supported Withdrawal Methods

Supported Withdrawal Methods:

- Credit/debit cards

- Bank wire transfers

- E-wallets: Skrill, Neteller, WebMoney, UnionPay

Processing Times:

- Credit/debit cards: Easy if you used one for deposits

- E-wallets: Usually processed within 24 hours

- Bank wires: Suitable for larger amounts but may take longer

Minimum Withdrawal Requirements

Minimum Withdrawal Requirements:

- E-wallets (e.g., Skrill): $5 minimum

- Bank wire: $30 minimum

- Credit/debit cards: $10 minimum

These minimums help to cover transaction fees; larger sums mean fewer fees in terms of a percentage.

How to Withdraw Funds from Your Exness Account

Processing Times:

- E-wallets: Takes 1-2 business days usually.

- Credit/debit cards: Generally 3-5 business days.

- Bank wires: 5-7 business days.

Fees:

- Exness Fees: Exness does not charge any fees for withdrawal.

- Bank Fees: Wire fee charged by banks in the amount of $10-$35.

- E-wallet Fees: Some e-wallets charge up to a 2% withdrawal fee, such as Neteller.

Consider the processing times and fees when choosing how to withdraw your funds. Learn more about Exness options you can use for opening the right account here.

Local Payment Options for Sri Lankan Traders

Exness offers convenience with local payment options for traders domiciled in Sri Lanka. You will be able to fund your account via local bank transfers or deposit directly from your Commercial Bank or Bank of Ceylon account. These local methods generally come much cheaper and are more convenient compared to international options; however, the transfer limits and processing time may differ.

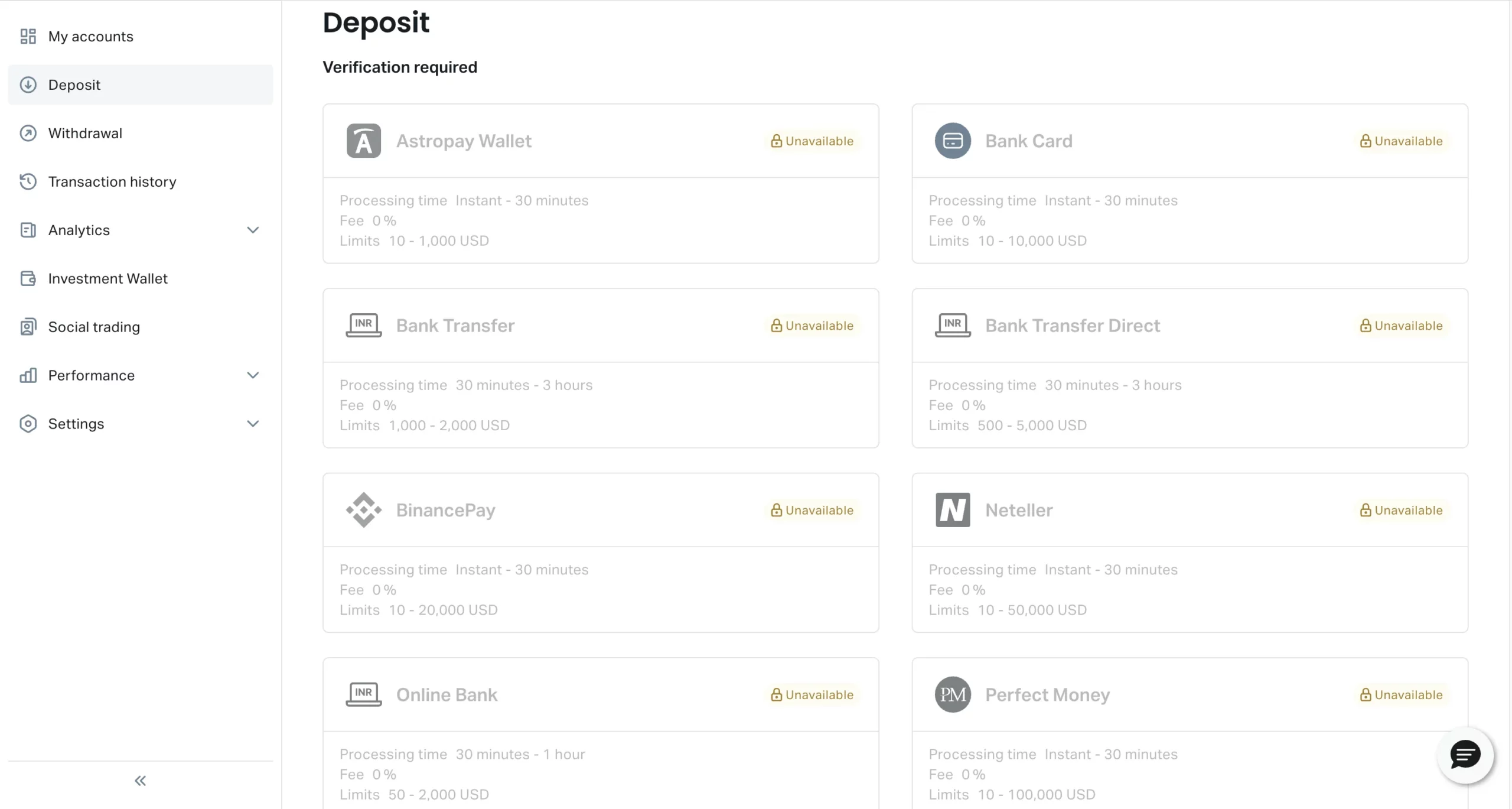

Security Measures and Verification

Exness cares more about money and information safety above all with a number of security measures. Among them are the following: protection of communications with encryption to protect data from interception, segregated funds—no money of clients is used by the company for its own operations, and verification of identity for all new account holders by Exness.

Account opening may require government-issued identification, residence proof, and the source funding details. Consequent steps have been instituted to prevent fraudulent acts and ensure compliance with the law.

Troubleshooting Common Issues

For various reasons, at times a deposit or withdrawal may go awry. To tackle such situations, Exness has at its command an able support team ready to step in with help. Common problems include:

- Declined Transactions: This could be because of low balance or card limit issues.

- Incorrect Payment Details: Entered wrong payment information.

- Technical Errors: At times, errors might crop up during payment processing.

Exness support will help you through the solution to your problem or investigate it further if need be. Do not hesitate to contact them – they aim to help and solve any issues as fast as possible.

Choosing the Best Exness Payment Method for Your Needs

With several options at your fingertips, choosing the right method may prove a bit tricky. Consider the following factors:

- Ease of Use: How easy is it to use this method?

- Fees: Are there any costs involved?

- Processing Time: How fast are the transactions?

- Transfer Limits: Are there any constraints on the size of your transfer?

- Local Options: Are local payment methods more beneficial for you?

For instance, e-wallets are pretty good for fast and low-cost deposits but might have a fee for withdrawals. Bank wires are better for bigger amounts although they are slower. Always use the method that best fits your trading style or preference.

Conclusion

Exness offers a great variety of ways to deposit and withdraw money; some methods even target Sri Lankan traders. Security is also taken care of by verification of the accounts and protection of private data. The support team will help you sort things effectively in case of any mishap.

One can go through all the options provided, looking for the method of payment that will suit his or her trading style best. You can just focus on your trading strategies and rest assured about the fund transfers.

FAQs

What deposit methods are available for Sri Lankan traders on Exness?

If you live in Sri Lanka, Exness has some local deposit options. You can add money using local bank transfers. Or, you can deposit straight from your Commercial Bank or Bank of Ceylon account.