What is Exness Calculator and How It Works

Exness Calculator is an extremely useful tool that will allow traders to calculate the key things, such as their potential profit, potential loss, margin requirements, and swap fees before actually making the trade. Traders can instantly calculate the financial outcome of a trade by using certain information, including the trading instrument, lot size, leverage, and account type. This calculator will not only be helpful in running risk management but also in planning trading strategies that will enable a trader to know their positions comprehensively before entering a market position.

Exness Calculator is quite an easy tool with which to work on this platform. A trader is expected to fill in the box with the asset he is willing to trade, the size of the trade, and the leverage. As based on the above-mentioned details, the calculator will provide instantaneous key figures: the margin the trade will require, the potential profit or loss of the trade, and swap fees that might be applied. This helps traders estimate their financial exposure and ensures they’re making informed decisions about their trades.

One of the main advantages of using the Exness Calculator is that it does these calculations in real-time, hence helping traders to work on adjusting their position and plans accordingly. It essentially aids in better risk management and an overall trade strategy by making clear what one can really expect from a particular trade.

The Exness Calculator serves several important purposes:

- Estimate profits or losses: Calculate potential outcomes before placing trades.

- Determine margin requirements: Understand how much capital is needed for a position.

- Calculate swap fees: See any overnight charges that may apply.

- Risk management: Use the data to make informed decisions and manage risk effectively.

By using the calculator, traders can plan trades more efficiently and control their risk exposure with greater confidence.

Main Functions and Features of the Exness Calculator

Exness Calculator offers several key functions and features that help traders plan and manage their trades effectively:

- Profit and Loss Estimation: The calculator allows traders to estimate potential profits or losses before entering a trade. By entering the asset, trade size, and other details, you can quickly see what to expect from a trade under different market conditions.

- Margin Calculation: It calculates the margin required to open a position based on the leverage and trade size. This helps traders ensure they have enough funds in their account to cover the trade and avoid margin calls.

- Swap Fees Calculation: The tool provides an estimate of any swap (overnight) fees that may apply if the position is held overnight, giving traders a clear understanding of the additional costs involved.

- Leverage Impact: The Exness Calculator also shows how different levels of leverage will affect the margin and overall trade exposure, helping traders manage risk more effectively.

- User-friendly Interface: The calculator is simple and intuitive, allowing traders to input different parameters and get instant results in an easy-to-read format.

These functions make the Exness Calculator a powerful tool for traders who want to manage risk, calculate key trade metrics, and optimize their trading strategies with greater confidence.

How to Use Exness Calculator

Using the Exness Calculator is easy and can be done in a few simple steps:

- Access the calculator: Visit the Exness website and find the Investment Calculator tool under the trading resources section.

- Select your trading instrument: Choose the asset you want to trade, such as forex, commodities, or cryptocurrencies.

- Enter trade details: Input the key trade parameters, including the trade size (lot), leverage, and account type.

- Choose your account currency: Select the currency in which your account operates to get accurate calculations.

- View results: The calculator will instantly display important metrics like required margin, potential profit/loss, and swap fees.

Input Parameters

When using the Exness Calculator, several key input parameters are required to generate accurate trade estimates:

- Trading Instrument: Select the asset type you plan to trade (e.g., forex, commodities, indices).

- Trade Size (Lots): Input the volume of your trade, typically measured in standard lots.

- Leverage: Set the leverage ratio you plan to use, which impacts the required margin.

- Account Currency: Choose the base currency of your trading account (e.g., USD, EUR).

- Direction (Buy/Sell): Specify whether you intend to open a buy (long) or sell (short) position.

These parameters allow the calculator to accurately assess the financial implications of your trade.

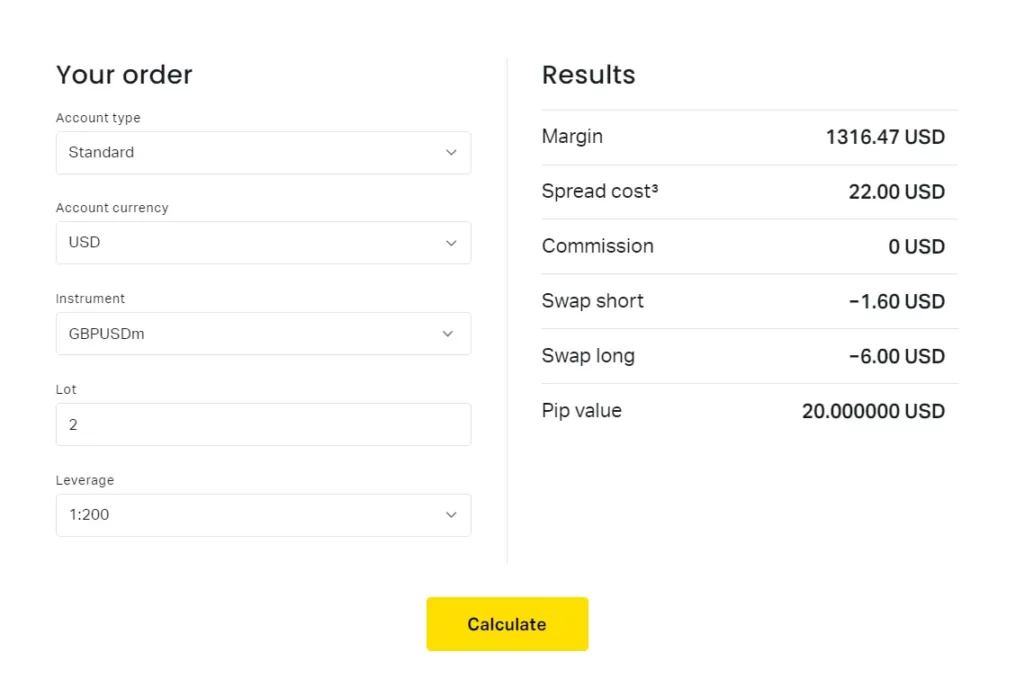

Explanation of Results

Once the calculation is complete, you’ll be provided with key results:

- Margin: This shows the amount of capital required to open your trade. It is calculated based on your trade size, leverage, and account currency.

- Profit/Loss: This value estimates the potential profit or loss from your trade, depending on the price movement and the direction (buy/sell) of your position.

- Swap Fees: If your trade is held overnight, this value shows any potential swap (overnight) fees or credits associated with your position.

- Pip Value: This is the monetary value of each pip movement for your trade size, helping you understand the impact of market changes.

These results provide a clear overview of your trade’s potential financial outcome, enabling better planning and risk management before entering the market.

Example of Using the Exness Calculator

Imagine you want to trade 2 lots of GBP/USD with leverage of 1:200. You choose GBP/USD as the trading instrument in the Exness Calculator. Now, you go forward to insert your trade size-choose 2 lots-and tap on the leverage 1:200 option. Choose USD as your account currency and state if you are buying or selling. After this information is filled in, the calculator will output some key figures, including the margin required, potential profit or loss, swap fees if applicable, and pip value.

For instance, if the margin required for that trade is $1,000, that amount will be displayed by the calculator as what needs to be in your account when opening the position. If the market goes up by 100 pips according to your favor, the profit will probably be $2,000. On the contrary, if the market moves in reverse to your expectations by the same number of pips, it would mean a loss of $2,000. This elaboration gives you an exact idea of the amount of risk and reward you are dealing with through this particular trade.

Advanced Features of the Exness Calculator

Besides simple calculations, the Exness Calculator can do so much more, making it a very handy tool for traders. You can, for example, estimate the potential outcomes for up to five asset classes: forex, commodities, and cryptocurrencies. This flexibility means that no matter what you are trading, the calculator can help you manage your risk and estimate your potential returns. It also gives very detailed information on the margin requirements according to your choice of leverage, which again will allow you to optimize your trading strategy.

Other advanced features include the swap fee calculation when positions are held overnight within the Exness Calculator. In this way, you get a correct estimation of your costs and potential profits in time, since you will consider the swap fees. The calculator integrates with market data in real time, and that provides the most accurate picture of your trade before you enter the market.

Risk Management Tools

Exness offers a range of professional tools for risk management throughout the trading process, capital security, and decision-making. Such tools become crucial in significantly reducing potential losses and thus managing risks in a volatile market. The major features of risk management tools offered through the Exness Terminal include:

- Stop Loss: A Stop Loss order will automatically close out a position if it moves against you by the amount you specify, so that further losses are limited. By setting a Stop Loss, traders are able to limit how much they can potentially lose on a given trade.

- Take Profit: This feature automatically closes the trade when it reaches your predetermined profit level. In such a way, it will help lock in gains and ensure that traders can bank profits without constantly monitoring markets.

- Trailing Stop: This is the feature that allows your Stop Loss level to trail the market price of a trade in its favorable direction. It helps lock in some profit and works by automatically adjusting your Stop Loss as the market moves in your favor, enabling you to realize greater gains while limiting your risks.

- Negative Balance Protection: Exness provides negative balance protection, which means traders can’t lose more than the amount in their trading accounts. This is quite useful during unexpected market fluctuations and ensures a trader would not have any debt to the broker.

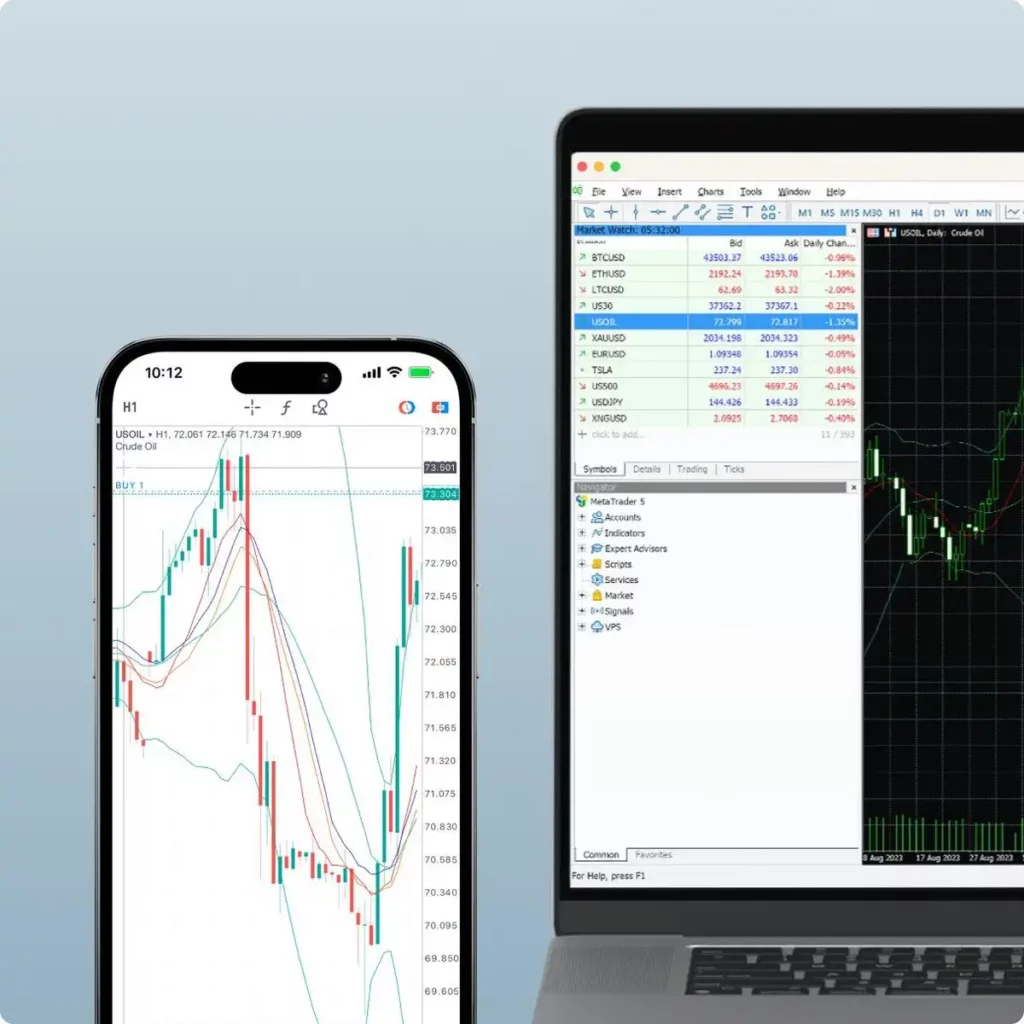

Integration with Trading Platforms

With smooth integration between its tool suite-including the Exness Calculator-and popular trading terminals like MetaTrader 4 and 5, Exness is in a strategic position to further enhance traders’ decision-making and execution of trades within a single platform.

- Compatibility with MetaTrader 4 and 5: The Exness Calculator can be used right alongside MT4 and MT5, allowing traders to strategize their trades and take the calculated data directly into the trading platform. It would ensure that traders will have real-time views on margin, profit, and loss directly from the Exness Calculator, which then can be used in the MetaTrader environment.

- Real-time Market Data: Exness Calculator integrated into MT4/MT5 means traders will have real market data in real time, guaranteeing freshness and accuracy. This real-time integration will serve to ensure that traders are able to plan their trades using the most updated information for better risk management and successful trade execution.

- Smoothening of Trading Process: You can incorporate Exness Calculator into your trading platform for the smooth processing of your operations. You will directly copy the calculated figures that show your potential outcome and fill them into the trading platform for placing orders, setting stop losses, or readjusting the size of trade.

Summary

Exness Investment Calculator is an excellent tool that a trader can use to estimate potential profit and loss, margin requirements, and swap fees before making the trade. The tool would enable traders to establish the financial outcomes from the trade in an easier and quicker manner by inputting details related to the trading instrument, lot size, leverage, and account currency. This calculator allows for a more efficient way of managing risks and planning trades with real-time calculations. It also includes flexibility options, such as configurable leverage, selection of account currency, and trading instruments, at the discretion of traders of any level of skill. Exness Calculator is already built into MetaTrader 4 and MetaTrader 5 platforms to facilitate the trading process and make sure that traders enter well-informed trades.

FAQ

What is the Exness Investment Calculator?

The Exness Investment Calculator is a tool that helps traders estimate potential profit, loss, margin requirements, and swap fees before executing trades.